Back in my university days, there were two books that had a deep effect on me and which I have since re-read at three different stages of my life. The first, which I found to be a wondrous journey into intellectual escapism, was by J.R.R. Tolkien and was actually a trilogy of three books: The Hobbit (304 pages), The Fellowship of the Ring (479 pages), and The Two Towers (415 pages).

Long before Peter Jackson was making those blockbuster films, many of us were enjoying late-night indulgences in the fantasy world of Middle Earth and "Bag End." I learned of Tolkien's masterpiece from an upperclassman teammate from Detroit who, in addition to playing a good game of hockey, had access to the most potent weed on campus.

He advised me to finish my homework, take three tokes of a joint he had given me, and read Tolkien. He was convinced that only under the influence of Columbia cannabis could one truly appreciate the visionary and allegorical powers of those three books. In my case, however, to follow his instructions would have led to twenty seconds of reading and a full night of intoxicated slumber.

Atlas Shrugged

The second book, a novel of over 1,000 pages, was written by a Russian-born Jew, Ayn Rand, whose father had his very profitable small business expropriated by the Bolsheviks in 1918, after which she escaped to America with a serious anti-communist chip on her shoulder. Her most famous work was Atlas Shrugged, written in 1957, which chronicled the story of a not-too-distant America, with its middle and working class gutted beyond recognition by a ruling class of corrupt politicians and businessmen who wielded power and influence back and forth to the detriment of the average laborer whose quality of life had deteriorated into squalor.

I first read it in university in my junior year only because it was not on the "recommended reading" list of literature for the students of the neo-conservative Jesuit institution. Many of my classmates attending lectures by Dr. Yeager (a layman teaching us "Finance101") would listen to him sermonize about the 1975 Fed under Arthur Burns, who presided over U.S. monetary policy during almost the entire decade of the Stagflation '70s, where stocks languished, and gold and oil thrived.

One morning, he mentioned a book most politicians hated called Atlas Shrugged, so I went to the university library to borrow it only to find that it was "not in inventory." I ran down busy Grand Avenue into the ghetto and whipped into the local dealer's shop fronting as an "underground bookstore" run with great efficiency by a black grad student called "James," who was amazed that I had the courage to venture into the largely-black section of town that abutted the downtown campus.

I bought the paperback version noting that it could have been mistaken for an encyclopedia or dictionary by its thickness, but once I started reading it, I found the first 200 pages agonizingly boring until about the 20th chapter, at which point I turned to the back of the book to see how many more pages of this nonsense I had to endure.

It was somewhere after the 200th page that the book magically transformed me from a yawning reader to a wild-eyed devotee and disciple. That is why the phrase "Who is John Galt?" has such significance to me because John Galt was the character that takes over the National Radio Station and rallies an entire nation to overthrow the thieves that had absconded with all of the resources of the once-gifted nation. For those of you that believe in the concept of "no free lunches" and are opposed to stimulus cheques or forgiveness of student loan debt, Atlas Shrugged is a must-read.

What prompted me to discuss Ayn Rand was watching politicians around the globe, from Ottawa to Washington and onto Brussels, all clamoring to dodge all association with the "woke" movement now that the mainstream of voters is repudiating the total malarkey that has corporate bigwigs blowing up their careers in order to satisfy the requirement set out by the "ESG movement."

Anheuser-Bush

First, the old Anheuser-Busch company, headquartered in good ol' Saint Louis, Mo., when I was in school, made the critical error of having a transgender individual featured in an ad campaign for Bud Light, a beverage consumed in excess by every truck-drivin', NASCAR-watchin', WWF-followin' redneck the nation over.

The result was a cataclysmic boycott of Bud Light and a 180-reversal in advertising policy, but far too late to save the brand. Sales of that beer fell off a cliff, and despite public statements apologizing to consumers, it was a little too late to undo the damage.

I can promise you that if Belgium-based InBev had not taken over Anheuser-Busch and the Midwesterners that used to make those decisions were still in charge, that mistake would NEVER have occurred.

ESG Movement

If Ayn Rand had been watching down from above and saw the antics at the Silicon Valley Bank, where undue focus on ESG adherence fogged over the need for risk controls at that bank, she would be screaming at the top of her lungs while pulling her hair out.

The company was renowned for its adherence to environmental ("E"), social ("S"), and governance ("G") issues, but since it had no CRO ("Chief Risk Officer") for an eight-month period leading up to their dissolution, they were great at acknowledging transgender people but forgot about acknowledging risk associated with rising interest rates and fleeing depositors.

Perhaps because I just turned seventy or perhaps because I grew up in a working-class aircraft factory town called Malton (Ontario) that I may have been indoctrinated with these somewhat archaic attitudes toward ESG.

However, this is not about what I think about LGBT issues because those issues do not affect me or anyone in my immediate family. My sister-in-law has a brother married to another guy, and that was twenty years ago, but we just accepted it and drove on with no fanfare or difficulty because they were "good guys," lots of fun at family gatherings, and not afraid to laugh at themselves.

My issue lies in the problem that these movements have on the efficiency of commerce and corporate profitability. Another good example is the Canadian mining business, where indigenous rights demands are clogging up what was once a wonderful system that set the stage for some of the largest mineral discoveries in modern history.

Today, no miner dares drop a drill rig unless he has a deal, etched in stone, with the local tribe.

Even then, thanks to the liberals that dominate the system, the deals are often thrown in the waste bin if the discovery turns out to be a big one. "Stand by for a slight change of rules" is more the norm rather than the exception these days in the wilderness of northern Canada. It makes doing business increasingly difficult.

As I scroll down through the pages of social media and blogs, the narrative is still dominated by the "weak," the "non-white," or the "underprivileged" souls that do not enjoy the same "entitlements" as that segment of the population that is the largest and the most well-off.

The majority of the shrinking middle-class, once predominantly white, Anglo-Saxon Protestants one hundred years ago, is now multi-ethnic (at least in Canada) due to liberal immigration policies since WWII. The "elite class" (the 1%) that owns and controls most of the assets (95%+), which is totally multi-ethnic, gets mistaken for those of a certain color or creed and who represent the majority of citizens, not the majority of rich, entitled citizens. Therein lies a huge difference.

The denouement of this rant is that I fully welcome the return to the sanity of politicians, legislators, and regulators in placing practicality before hysteria in the move to ensure fairness to all citizens in the interest of economic health. I further urge that the school curriculums exclude all references to sexuality or gender, which I believe lies solely as the responsibility of parents and no one else. As a broad brush approach, more attention to workforce preparation as opposed to social media acceptability training would yield far better aggregate benefits to the quality of life than making sure a boy's eyebrows are being plucked properly.

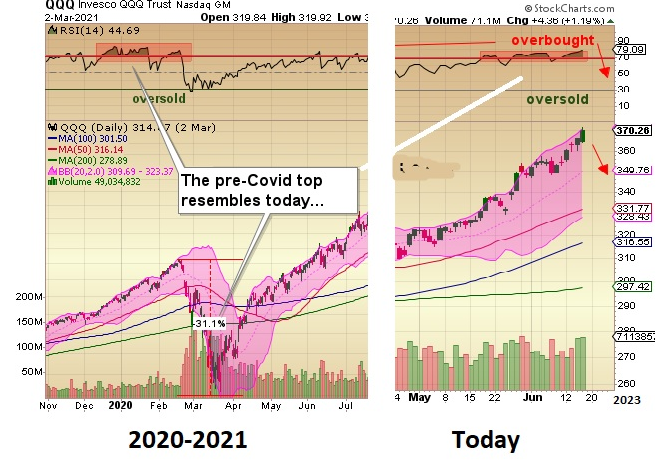

I was a cautious stock market bull from October until January and then a vocal bull afterward, with the QQQ now ahead over 47% since the lows of last October.

Today, professional investors are chasing stocks in a "fear of job loss" frenzy as massively offside short positions are covered, and woefully-inadequate equity allocations are being fortified. This onslaught of "frenetic FOMO" is not only awe-inspiring, it is also laughable.

After prolonged periods of uncertainty, it is not uncommon for stocks to engage in a "relief rally," where the fear of negative surprises subsides, and the fear of being left behind ("FOMO") takes control.

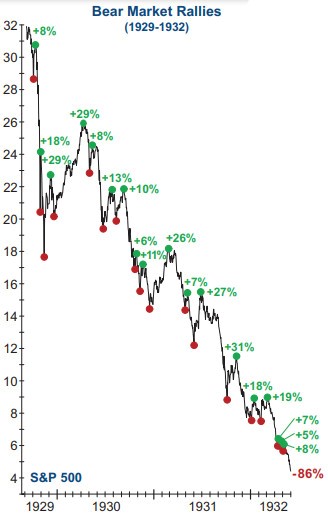

In fact, some of the greatest rallies in history preceded death drops of unimaginable magnitude.

In late 1929, after crashing from 320 to 180, there was a 29% rally off the lows that took it back to 260 before the real bear re-emerged, taking the Dow down to 41.22, a loss of 86% in three years.

Mind you, that was long before central bank intervention and interference.

So, it is perhaps an unworthy comparison to today's environment.

However, this rally is arguably one of the most-hated and ill-trusted that I have seen in years, with RSI now sitting atop the 70 line, just as it did for most of December 2019 and early 2020 before rolling over and crashing 31% in a month.

I am not suggesting that the markets are an impending dumpster fire, but an orderly 10% correction would not only be healthy, it would set up the potential for a smashing year-end rally after it is determined that the much-awaited recession becomes a figment of bearish imagination and short-seller prayers, both of which are at a fever pitch right now.

The usual line-up of podcasters bearish on stocks and bullish on gold and silver are eating out of dog food cans these days.

But the number of them is dwindling rapidly, which is once again a sign of capitulation by the bear camp, yet another sign of the inevitable pullback just around the corner.

Junior Resource Stocks

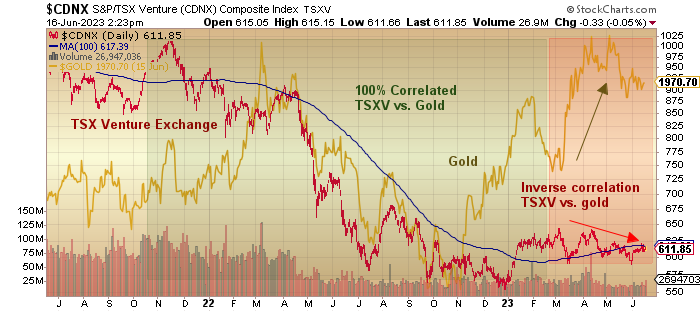

If you grant me the assumption that the TSX Venture Exchange (the Canadian junior resource stock exchange) has been historically entwined in a 100% correlation to the price of gold, then please observe the chart going back to 2020 that clearly illustrates one of the major problems with the Canadian Junior Resource Sector.

There was a near-perfect positive correlation between the movements in gold and the movements in the TSXV up until March of this year when it seemed like the unstoppable PDAC curse took hold of everything "resource."

Up until then, TSXV stocks tended to move in tandem with the gold price, at least directionally and to a lesser degree in "amplitudinal terms. It is no surprise to me that investors are staying away in droves because even regional bank stress in April and May could propel gold to new highs, and even the probes to test area above US$2,000/ounce could not get the TSXV to respond.

Canadian junior resource stocks need to attract some new capital, and that means that a new discovery that maintains shareholder interest for more than a couple of days or an explosion in metal prices forcing money into the metal developers and explorers as proxies for the physical metals themselves.

Gold

Summer is here, and the Scugog Swamp is teeming with big ugly carp feeding mightily among the gathering weeds that prevent even the shallowest of boats from getting to shore without trimming right up or yanking the lower unit right out of the water.

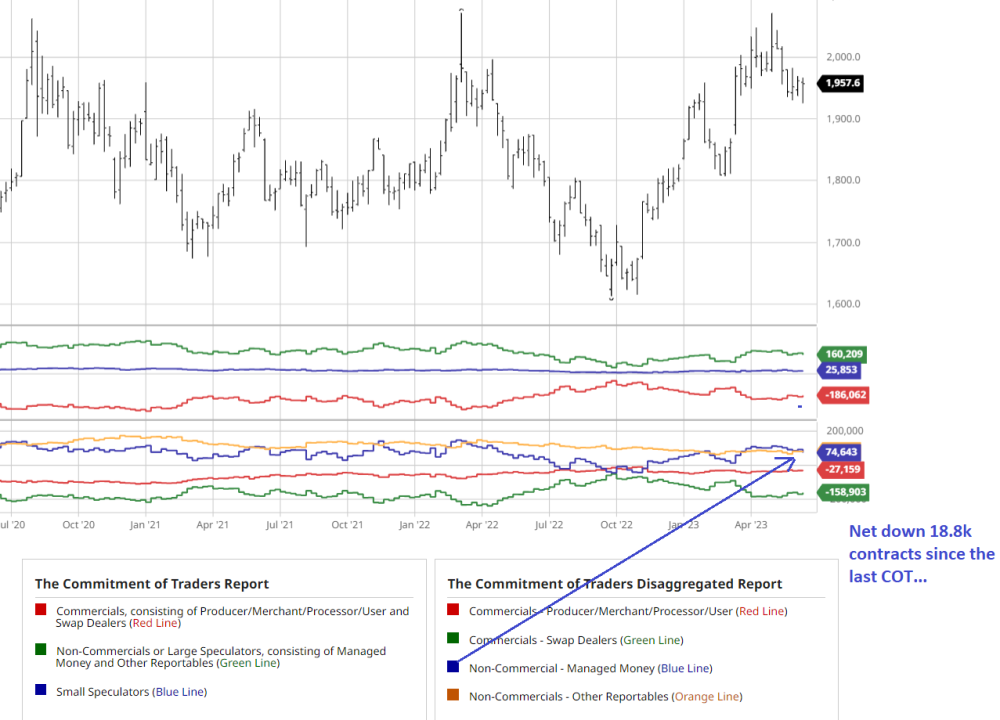

The good news for gold this week is the notable reduction in net longs held by the Managed Money (hedge funds), as shown in the COT. Hedgies net sold 18.8k gold contracts while the Commercials stepped up for 13,742 contracts. With open interest declining to historically bullish < 450k contracts, gold is probably ready to move higher.

Nevertheless, I am out of the gold market until it either breaks out above US$2,100 or breaks down on a close below US$1,950.

The summer will officially arrive in six days, which means that Labor Day will come sooner than we would all prefer.

Sign up for our FREE newsletter

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.